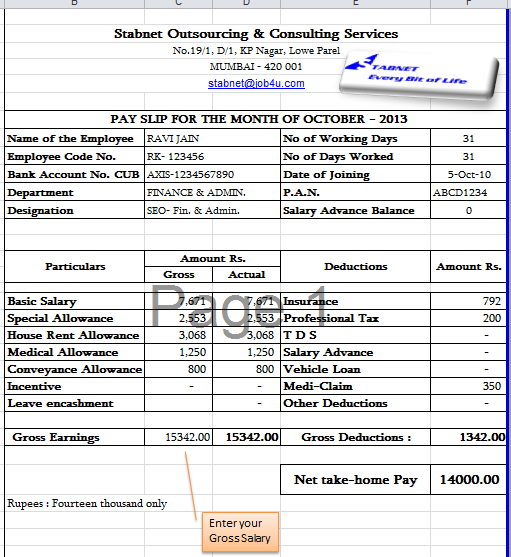

If you fail to do so you need to pay with interest.ĭeductions include PF, ESI, PT (if applicable), Income Tax, and Compensation for Notice Period not served. (number of days of non-availed leaves * basic salary) / 26 days ( Avg paid days in a month).įor e.g., If an employee has 25 earned leaves which is not availed and basic salary = 5000, then encashed amount will beĪs per Section 7 (3) of the Payment of Gratuity Act 1972, Gratuity should be offered within 30 days of the resignation.

The procedure has to be carried out by the employer after the employee resigns from their services.

At this time, he/she has to get paid for the last working month + any additional earnings or deductions. What is Full and Final Settlement in Payroll?įull and Final Settlement commonly known as FnF process is done when an employee is leaving the organization.

Hello, in this post we will discuss the Full and Final Settlement in payroll.

0 kommentar(er)

0 kommentar(er)